10 Precision Companies to Watch for U.S. Specialty Crop Markets

The world of precision agriculture technology is as fast moving as it is complex. Companies that at first appeared viable for the long run have long nabbed their long-awaited venture capital exits, and the segment potentially will appear dramatically different in six months from any market snapshot we capture today.

-

-

1 of 10

Abundant Robotics

Abundant is the California-based outfit responsible for the industry’s first-ever commercialized robotic apple harvester (pictured), and literally just a few months ago the company announced it had completed its first completely autonomous apple harvest down in New Zealand. The group is advocating the robot-as-a-service business model, so growers won’t have to save up for years for the massive upfront investment that most robotics technologies carry, and with the company recently releasing findings that over 40% of U.S. apple growers have trouble securing enough harvest labor for the fall harvest window, bringing in a couple Abundant robots to do the job isn’t as far out there as it perhaps once seemed.

-

2 of 10

Crinklaw Farm Services

This tiny outfit out of California is responsible for developing what’s thought to be the world’s first autonomous orchard sprayer with its Global Unmanned Spray System (GUSS) bot (pictured), which can reportedly maintain guidance accuracy without a viable GPS signal. Another impressive capability of GUSS: An operator in one of Crinklaw Farm Services' (CFS) mobile command units can manage up to 10 GUSS bots at one time, allowing for larger scale field work coverage than most of the farm bots we’ve seen in the past. The company was reportedly taking pre-orders on GUSS at the 2019 World Ag Expo in February, and with the group already making bold claims such as the GUSS unit being “more precise than . . . conventional spray equipment,” it only makes sense (price tag pending) that specialty growers and service providers alike would be interested in checking GUSS out.

-

3 of 10

FloraPulse

Developed by researchers from Cornell University, FloraPulse’s patented microsensors reportedly can accurately measure water potential in any vineyard or orchard. It’s a similar concept to Yara’s Water Sensor in that FloraPulse also measures water stress by taking pressure readings and then processing the data and running algorithms over it, giving growers a reading on plant water pressure that can be correlated back to irrigation schedules. The technology is not yet commercialized – Christina Herrick, Senior Editor of American Fruit Grower, reports that 2020 is the target for commercialization in California almond orchards and vineyards – but shows promise for helping specialty growers get their watering precisely correct. Photo: Sensor installed in the trunk of a grapevine. Photo by Alan Lakso

-

4 of 10

Hortau

Deployed in similar fashion as EC data, Hortau leverages its patented “soil tension sensing” technologies to help specialty growers know precisely when and where to irrigate. Data from the sensors is displayed real time via Hortau’s mobile app, giving growers the ability to react to changing soil conditions on the fly. One of the main selling points with this approach is the fact that the readings are not influenced by soil salinity or alkalinity (pH), whereas traditional EC scans would be. Hortau’s website is packed with testimonials from growers producing everything from almonds to cranberries to strawberries to No. 2 yellow corn.

-

5 of 10

Indigo Ag

Named the top CNBC Disruptor 50 for 2019 and dubbed by the news agency the “biggest breakthrough in agriculture to help feed the planet,” Indigo Ag’s intriguing go-to-market strategy (digital ag services plus proprietary microbial seed treatments) has netted the Memphis, TN-based startup an impressive recent track record. CNBC reports the company expects to see 25,000 growers using its technology to produce food on 4 million acres by the end of this year, and the group is on target to surpass annual revenue of $1 billion in 2019. Add in several other factors – including the release of its recent Indigo Marketplace, which matches grain growers with food processors and other buyers looking for very specifically produced grains; and the company explicitly stating its plans to move in the near future from a sole row crop focus into specialty crops (coffee and high-value nuts, fruits, and vegetables, according to CNBC) – and it’s easy to see why CNBC singled out Indigo to head up its annual ranking of disruptive companies.

-

6 of 10

Priva

Priva is often recognized as a world leader in greenhouse lighting automation and controls systems, and the company has found a niche in championing energy-efficient solutions in protected ag and vertical farming operations. True, we see these alternative growing strategies as crucial to increasing food production in a world where urban sprawl promises to remove more land from production than at any time in the history of human civilization, and it’s going to take sustainable solutions like what Priva’s been working on to sell consumers on the future viability of protected ag. The company is also on the forefront of offering digital traceability programs for protected ag growers.

-

7 of 10

Prospera Technologies

Valley Irrigation’s newest and perhaps most ambitious digital ag offering to date, Valley Insights is slugged with the “powered by Prospera Technologies” tagline, as it is Prospera’s backend algorithms that power this new artificial intelligence product that promises “to provide true insights into your fields, including recommendations sent directly to you via SMS text message notifications.” Basically, the platform leverages in-season, fixed-wing imagery to detect pivot-related faults and crop-related stress caused by weeds, nutrient deficiencies, and improper chemical application. There’s also a neat sort of open-source component to the program, as the system’s AI-driven recommendations are evaluated for accuracy by the farmer or ag service provider end users, allowing the system to self-calibrate over time and become more accurate as more users feed more data into the system.

-

8 of 10

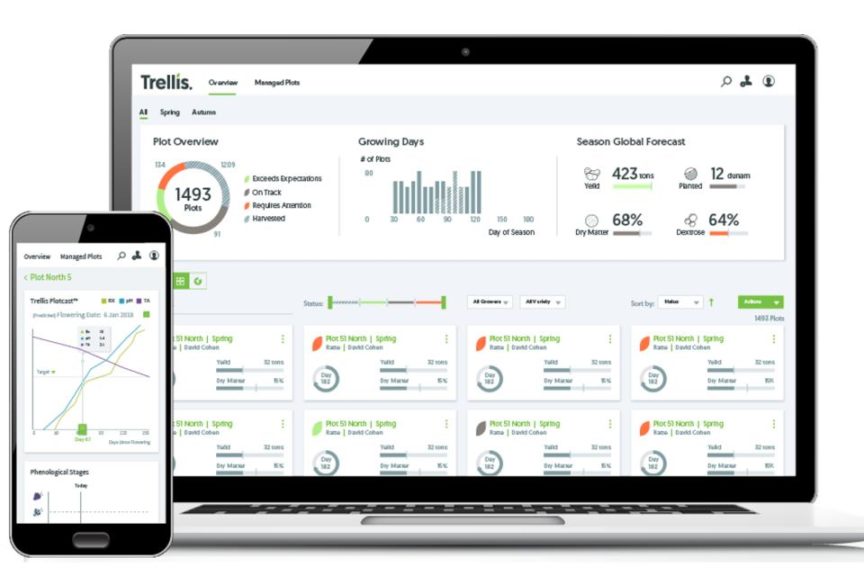

Trellis

Another outfit touting its AI-powered insights delivery platform, Trellis claims its AI has studied more than 1.5 million production seasons of historical harvest data and collected 5 million-plus daily data points to help optimize 10,000+ blocks of food crops. The startup also offers supply chain insights as well as market intelligence services, both of which helped the outfit secure Russian River Valley Winery as a client, in turn saving the grape crushing winery $528,000 on its annual ‘Chardonnay’ grape purchases.

-

9 of 10

Veris Technologies

Veris is known as the forefather of EC mapping in row crop ag, but the practice has enjoyed a ton of buy-in from specialty growers – specifically wine growers in California that are looking to manage their blocks, or management zones, from the soil up to produce different characteristics and flavor profiles for the various varieties of wine grapes they match to numerous brands of wine. Veris launched its iScan+ soil sensing platform at this year’s Commodity Classic in Orlando, FL, U.S. touting the system’s ability to provide four real-time soil measurements – moisture, temperature, CEC, and organic matter – versus the previous rig, which only measured CEC and OM.

-

10 of 10

WaterBit

WaterBit describes its Iot-based irrigation automation and monitoring platform better than I ever could, so here goes straight from the website: “WaterBit uses a hub-and-spoke model with one gateway acting as the hub and field-based sensors as a spokes. The sensors feed data into a single gateway that can cover 1000+ acres. The gateway sends the data to the cloud, which allows for 24/7 remote monitoring and irrigation control via a computer or mobile device.” The company has worked with a veritable Who’s Who in the specialty crop markets in the Western U.S., with perhaps fresh produce giant Bonipak the most notable, and was profiled in May by Forbes magazine.

View all

Abundant Robotics

Crinklaw Farm Services

FloraPulse

Hortau

Indigo Ag

Priva

Prospera Technologies

Trellis

Veris Technologies

WaterBit

Still, it’s worth knowing who the major players are and what they are working on to get a good idea of where the market is headed in the future.

The technologies moving the needle at the grower and service provider levels have shifted to more soft goods, such as offerings enriched by artificial intelligence and machine learning, digital algorithms in mobile software to process and identify potential issues from aerial imagery scans, and now-concept-but-soon-to-be-reality technologies like blockchain.

Download the State of U.S. Precision Agriculture Report

Scan the slideshow above to see a list of precision technology companies we at GrowingProduce.com and its related brand titles feel have a chance to move the needle with specialty crop growers in the next year or two. Feel free to contact me ([email protected]) if you disagree with our choices, or you’d like to get a company or product on our radar that you feel we’ve left out.

Subscribe Today For

Matthew J. Grassi is a former Technology Editor for Greenhouse Grower and American Vegetable Grower, both Meister Media Worldwide brands. See all author stories here.