How Supply Chain Backlogs Are Affecting Florida Ag

There have been a multitude of analogies used to explain the supply chain issues impacting delivery of a wide array of products that Americans have long taken for granted. One apt description is that it’s an accordion effect. One ship sits in port days longer than it should waiting to be offloaded, then other ships back up offshore waiting for a berth. This is followed by a lack of trucks and chassis, stretching the accordion of delivery delays even further.

Perhaps it is most tangible in empty grocery store shelves, but this thinly stretched accordion has touched Florida specialty crop growers as well. Tori Rumenik, Commodity Services and Supply Chain Manager with Florida Fruit and Vegetable Association, has been tracking supply chain disruptions and says the problem is widespread.

“We are seeing disruptions throughout the agriculture supply chain in Florida,” she says. “When we look at the supply chain end-to-end, inputs like agrichemicals and fertilizer are in short supply because of production challenges, hold ups at ports, and shortages of packaging materials. This means growers are facing unpredictable lead times for product without guarantee that they can find what they need.

“Pallets are in short supply from competition in other industries and from pallets holding inventory in warehouses. Shipping containers are in short supply and, in some cases we’ve heard, impossible to find. Labor is hard to come by,” Rumenik says. “And with transportation, the truck driver shortage is a very real issue, diesel prices continue to rise, and freight rates are way up. We can talk all day about how we need goods moved off ships at ports, but the missing link is the trucks and drivers to take that product from the port to a distribution center and then on to the end user. All these disruptions mean much higher production costs for growers, especially as the costs compound on each other. Growers are sounding alarm bells that they are experiencing rising costs like they’ve never seen before.”

Eric Hopkins, Senior Vice President of Belle Glade-based Hundley Farms, is among those sounding the alarm. He has commented to a number of national media outlets on supply chain impacts on agriculture. He spoke to NBC News about concerns over farm equipment shortages, which could be worsened by the John Deere manufacturing workers’ strike.

“It’s got us worried for sure,” Hopkins says. “They’re [John Deere] already low on inventory and parts right now. A strike is only going to exacerbate things, making it worse. If it lasts for a while, not only will they not have new tractors, but when you have a breakdown and there are no parts, your tractor is just going to sit there not being able to harvest or plant a crop.”

Eric Hopkins also appeared on Fox News in late October to address how the supply chain issues are impacting local ag interests.

Getting Goods Delivered

The supply chain issues are not just impacting growers’ ability to access things they need to grow a crop, but also to deliver what they have grown. Dan Richey, President of Vero Beach-based Riverfront Packing, says they have been adapting to challenges to get grapefruit shipped to key markets overseas. About 75% to 80% of the grapefruit packed at Riverfront is shipped to foreign markets, with Japan, South Korea, and the European Union (EU) being key geographies.

Fruit from Riverfront ships from ports in Jacksonville, Savannah, and Charleston. Shipments to the EU are least impacted by supply chain backlogs. Normally, it takes 14 to 16 days to arrive in ports in Antwerp and Rotterdam. Currently, they are experiencing delays of four to five days, waiting for ships to arrive. The Savannah port is experiencing longer delays than Jacksonville or Charleston. But Richey says Asian markets are a different story, especially Japan.

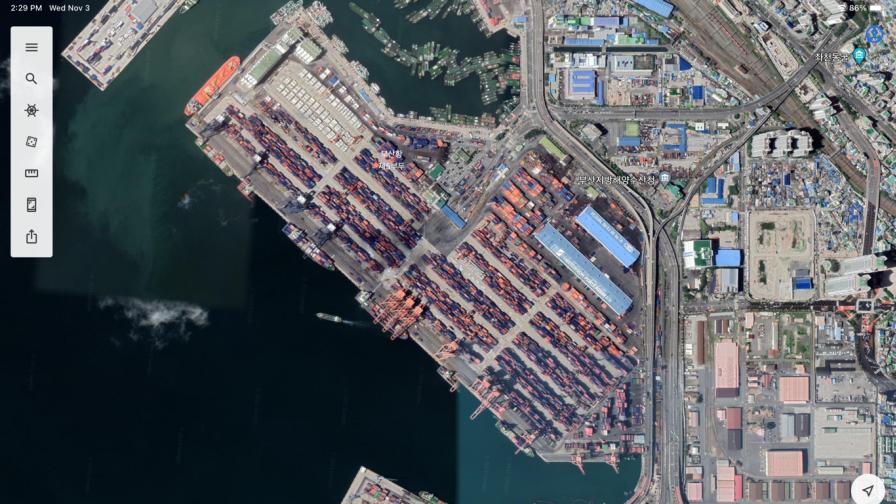

“Typically, our first port of call would be Tokyo, Japan and the second would be Osaka,” Richey says. “That would be a 30- to-32-day voyage. But right now, there is no direct port of call to Japan, so all our shipments must go into Busan, South Korea. The grapefruit is then transferred to a feeder vessel that takes it to Japan. So if we experience a four- to five-day delay in Savannah, that ship won’t match up with the feeder vessel, and we might have another delay in the port at Busan. So net-net, what typically takes 30 to 32 days is now taking as much as 50 days to get our fruit to Japan. I am not worried about the fruit. It can carry that length of time, but it has been a very real challenge for our logistics people and freight forwarders.”

Supply chain issues from a bird’s eye view. With no direct port to Japan, Florida grapefruit is being shipped to the crowded Port of Busan in South Korea. From there, the fruit is transferred to a feeder vessel for transit to Japan.

Image courtesy of Google Earth

Richey adds that in a normal year, early harvested fruit is sometimes trucked to the West Coast and shipped to Asia out of ports in Long Beach, Los Angeles, or Oakland. That is a quicker transit of 13 to 14 days on the water and about 20 days total. But the supply chain problems on the West Coast are much more pronounced, not to mention finding truckers to get it there.

“Anything we send to the West Coast goes in a regular refrigerated trailer. And when it arrives, it goes to a transfer station and the fruit is loaded on containers. With everything so out of whack over there, you might get to the transfer station and find out there are no containers, chassis, or ships available to take the fruit. So you could run into situations where you have fruit hung up for weeks, which is unacceptable. Right now, we have abandoned the West Coast until this gets sorted out.”

Rumenik adds that the entire Florida fruit and vegetable industry is working hard to make sure produce makes it to retail and wholesale destinations without interruption.

“Despite all of the challenges with the supply chain, we do not foresee issues with the timely delivery of product,” she says. “What we cannot say for certain right now is how much prices will change for consumers at the grocery store or their favorite restaurant.

“Everything from fertilizer, chemicals, pallets, crates and boxes, tractors, equipment parts, diesel fuel, and transportation costs (among others) are up exponentially. In some cases, the costs have doubled, if not more, when compared to years past. And they seem to be rising daily. At some point, those costs do get passed on to the buyer and/or consumer.”

Trucks have long waits ahead of them at ports, especially those on the West Coast.

Photo courtesy of Brighten Freight Inc.

Moving Forward

The just-in-time delivery model is a modern marvel, thus, it is a shock to the global system to see it so out of sync. But it is so large, and so ingrained, that this disruption will not mean its end. Certainly, there will be lessons learned and modifications made so that an episode such as this will not be as severe in the future.

“The just-in-time model is still a viable and valuable one,” Rumenik says. “When it works, it works well. And when it is constrained, like we are seeing now, we adapt and navigate.

“The produce industry is inherently a just-in-time model as we bring perishable fruits and vegetables to retail and food service at the peak of freshness. When thinking about improving supply chain processes, we must remember that our fruit and vegetable shippers live in the world of just-in-time. The benefit we have now is that we are seeing where the breakdowns exist and bear the burden to figure out how to strengthen them.”

Many prognosticators predict it will be well into late next year before backlogs begin to ease. In the meantime, adaptation and making the best of what’s in front of us will be the name of the game.

“This logistics breakdown is in somebody else’s hands,” Richey says. “We are just receivers of information and can only react. This is just going to take time to work through.”