Agritourism Proving To Be a Boon for More and More Berry Growers

Berry growers continue to thrive at direct-to-consumer marketing while exploring new avenues to the business strategy. More than half (53%) of the berry growers surveyed in American Fruit Grower’s 2023 State of the Industry report generated at least three-quarters of their 2022 revenue through direct marketing. More telling, many of those growers, 80% of whom own farms with fewer than 25 acres, turned a profit largely because of direct sales and agritourism.

Some examples as to how they did so:

“We sold in a farmer’s market,” an Indiana grower says.

“We added a retail outlet,” a Vermont grower says.

“Roadside sales,” a New Jersey grower says.

“We opened the farm for u-pick,” a Texas grower says.

“We sold berries already picked and delivered to other farm stands,” a New York grower says.

“More agritourism,” a Washington state grower says.

“Due to freeze damage, we did some farmer’s market sales in addition to pick your own,” a South Carolina grower says.

“We sell more direct to consumers because of falling prices and heavy regulations by government,” a Washington grower adds.

“We had a lower price than our neighbors,” another Washington grower says.

Contrary Price Points

Interestingly, berry growers varied in their stances last year on price setting for their own sales.

“We raised prices for u-pick,” a Washington grower says.

“We kept the price stable, which brought in more pickers from other areas and resulted in all fruit getting picked,” a Massachusetts grower says. “Most other growers raised prices 20% to 50%.”

“Went up in price across the board,” another Massachusetts grower says. “People expected the price to go up. In hindsight, I should have gone up more.”

Constant Work in Progress

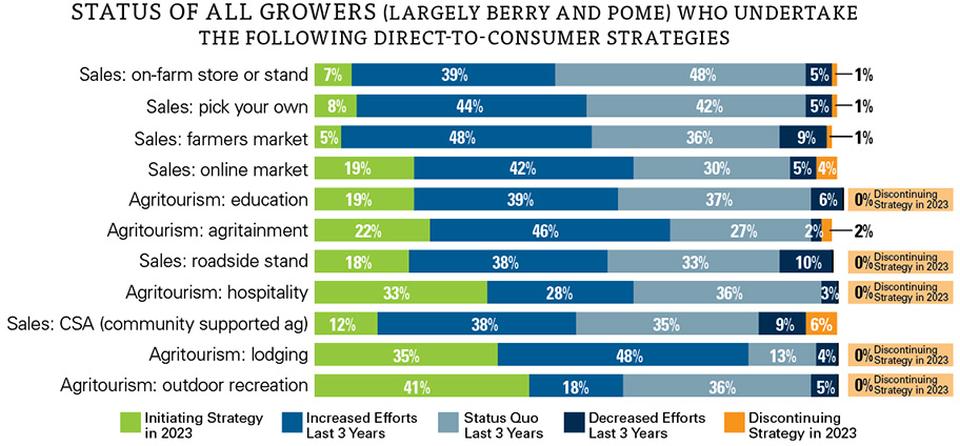

With direct-to-consumer marketing comprised of at least six forms of direct sales and five forms of agritourism (see chart), growers have multiple approaches to contemplate.

“We’re always changing,” according to a New York grower.

“We’re still deciding on a direction,” a Maryland grower says.

“We’re just starting a more detailed plan,” a Washington grower says.

The most popular strategies — all sales-specific — are, in order: on-farm stores and stands; pick-your-own; farmers markets; and online markets. Other sales approaches include roadside stands and community-supported agriculture.

“Ninety-five percent of our sales has been pick your own,” an Arkansas grower says. “With [an] increase in blackberry production, we may start sending some fruit to the farmers market.”

“The u-pick works great,” a Louisiana grower says. “Everyone leaves with multiple items: eggs, berries, flowers, honey.”

Pick your own (PYO) does especially well when using social media to promote, according to an Indiana grower. Adds a Massachusetts grower: “PYO has been very good. We have not really tried anything else, but we’re moving forward to online sales.”

“Online sales have done well since COVID,” a New York grower says.

“The pandemic impacted the number of people who came to pick blueberries,” a New York grower says. “However, these customers wanted to buy locally and were very particular about the quality of the berries.”

One tip from a Pennsylvania grower to all colleagues looking for more positive — and accurate — direct sales: “I added a digital scale,” he says.

A-maze-ed by Agri

Agritourism is divided into five categories:

- Education — e.g., demonstrations, tours, night activities

- Agritainment — e.g., hayrides, corn mazes, haunted barns

- Hospitality — e.g., restaurants, event space rentals, tasting rooms, farm-to-table dinners

- Lodging — e.g., farm stays, guest ranch, B&Bs, camping, cabins

- Outdoor recreation — e.g., hiking, bird watching, cycling, hunting, fishing

Among those berry growers who participate in direct-to-consumer marketing, a majority are enthusiastic about each of the five categories. No fewer than 58% of growers — and up to 83% in the case of lodging agritourism — have either increased their efforts the last three years or are initiating at least one of the strategies this year.

“We would like to do a corn maze for the first time,” a New York grower says.

School field trips have succeeded at farms in Kentucky, Ohio, and Wisconsin. The berry grower in Wisconsin offers a petting farm as well.

In the case of a Washington grower, one of his sales outlets has become the crowd draw. “Our farm stand has moved from more of an afterthought to becoming a destination,” he says. “The same is true of farm tours. Concerts and festivals will be back this year after COVID disruption.”

In some cases, the tourism comes to you rather than vice versa. A grower in South Carolina is benefiting from bike/hike trails the city constructed next to his farm. “We did no work, but the increased traffic has been beneficial,” he says.

In other cases, an otherwise great idea falls flat. “My insurance agent put the nix on the camping/AirBnB,” the Louisiana grower says.