How Agriculture is Growing in Age of the Connected Consumer

In 1858, the American entrepreneur Cyrus West Field, along with partners, spearheaded the laying of the first telegraph cable across the Atlantic Ocean, connecting Europe and North America. It would take the time to communicate a message by ship from 10 days down to a matter of minutes.

Among the first messages sent via the cable was a congratulations from England’s Queen Victoria to President James Buchanan. The cable was celebrated worldwide. There was a 100-gun salute in New York City, big parades, and fireworks displays.

While that first cable failed only a month later and was not fully repaired until 1866, it set off the global communication age that progresses to this day. In late 2017, Microsoft and Facebook announced the successful laying of a cable in the Atlantic between Spain and Virginia Beach in the U.S.

The Marea cable, as it is called, can transmit 160 terabits of data per second, which is the equivalent of streaming 71 million HD videos at the same time. It is 16 million times faster than an average home internet connection, Microsoft claims.

Cables, wires, and satellite signals have connected the world in ways that were unfathomable only a decade ago. People essentially have access to the world in the smartphones that fit neatly in their hands.

Already, this connectivity has had far-reaching implications on how people learn about and make decisions on the food they purchase. As digital connections grow faster and the Internet of Things touches just about every aspect of everyday life (yes, there are smart toilets now), the impact on what is grown and how it is grown will only increase.

Rick Stein

Rick Stein, Vice President of fresh food for the Food Marketing Institute, says growers should be aware of these changes because they will come with challenges and opportunities. He calls the phenomenon the “connected consumer,” because consumers can now access so much information, so easily about their food-purchase decisions.

This is especially relevant to the specialty crop industry. The produce department came in second to price when consumers were asked about the primary drivers that make them choose one retail outlet over another. Because of this, FMI research indicates that 85% of retailers plan to allocate more space and resources to fresh foods. Stein says growers can be assured that consumers are searching for information on produce items and who grows them.

“The next time you are in your local grocery store, walk around and observe how people are interacting with their devices when shopping,” he says. “As an industry, we have to embrace this both from the grower and retail side.”

Transparency and Convenience

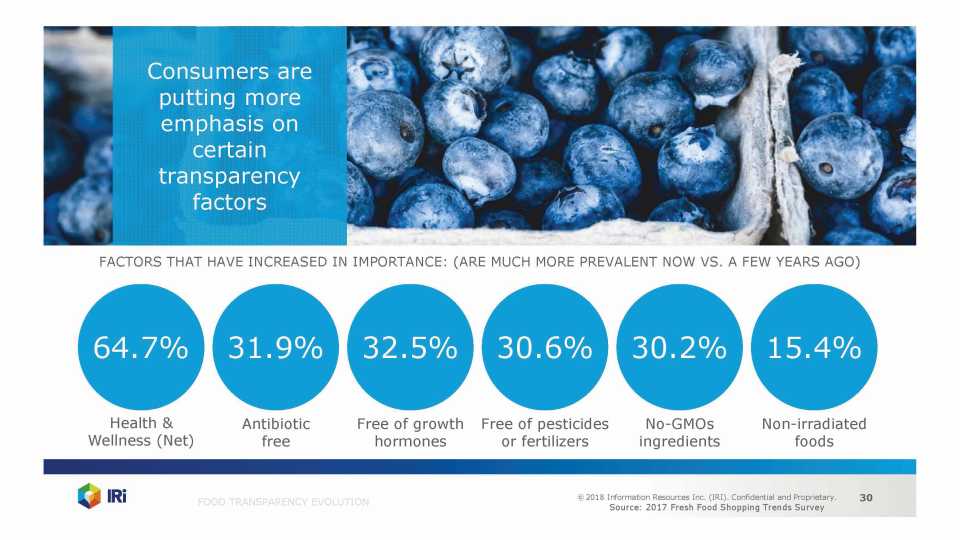

With Millennials making up a larger and larger share of food purchases, retailers are catering to their demands and needs. One of their demands is transparency (with education) and the other is convenience.

“Millennials, Gen Z, and even some Gen X age groups want to know where their food comes from,” Stein says. “And this younger generation wants education on how to prepare healthy foods.”

Stein points to a statistic that shows that frozen vegetables are really taking off with the younger generation. He says this is most likely tied to ease-of-use and education.

“The bag of frozen vegetables says put it in the microwave and press two minutes, so it is easy and there is instruction on how to prepare it,” he says. “These younger consumers also have learned that frozen vegetables have as much nutritional value as fresh produce. Right there you have an example of education and convenience.

“There is no reason this can’t be done in the produce department of stores,” Stein continues. “If you take time to provide education to the consumer about these products, it might influence their purchase.”

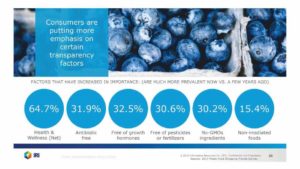

When it comes to transparency, 57% of consumers also are motivated by social and cultural factors in food production like sustainable growing practices (including organic), fair wages for workers, animal welfare, and less packaging.

Digital Footprint

Stein says small and larger farms should create a digital footprint, so these connected consumers can find them. This might include a website and social media presence. This communication can originate from in-store displays and on packaging via website URLs or scannable smartphone codes.

“There are all kinds of ways growers can connect to the consumer and do it in a way that makes the retailer happy,” he says. “Retailers are dealing with tight labor as well and don’t want to have a bunch of people in the produce section to explain everything to the consumers.

“Anything you can do as a grower to communicate and educate the consumer, the retailer is going to applaud it. It also will build loyalty with the retailer and consumer because you will become a trusted adviser on fresh foods.”

Larger fruit and vegetable farms in Florida used to shy away from the media and public spotlight. But, as the connected consumer has become a force, these larger operations have invested in their digital footprint, providing robust websites and social media loaded with information about the items they grow and recipes using those items. They retain celebrity chefs and social media influencers to promote and educate consumers about the crops they are growing and selling to create demand.

Smaller farms can make the connection as well. Stein notes playing up the “local” aspect of a small farm is a good hook with retailers and consumers.

“Just because you have a small farm doesn’t mean you can’t connect,” he says. “Maybe it is making an in-store appearance to answer questions from shoppers about what you grow. But, you really have to have a mindset that this is something you want to do rather than why you can’t. Maybe you don’t have a website but ask what you can do [and create] a social media presence.

“There is a whole generation out there that really does not know about the nutrition benefits of fruits and vegetables and how to use them. Educate them.”

Stein does caution that access to all this information can present challenges for growers. When it comes to things like sustainability and fair wages for workers, who defines what is right or wrong? For consumers with no connection to the realities of growing food, their definition of these standards could be unrealistic and unsustainable for growers.

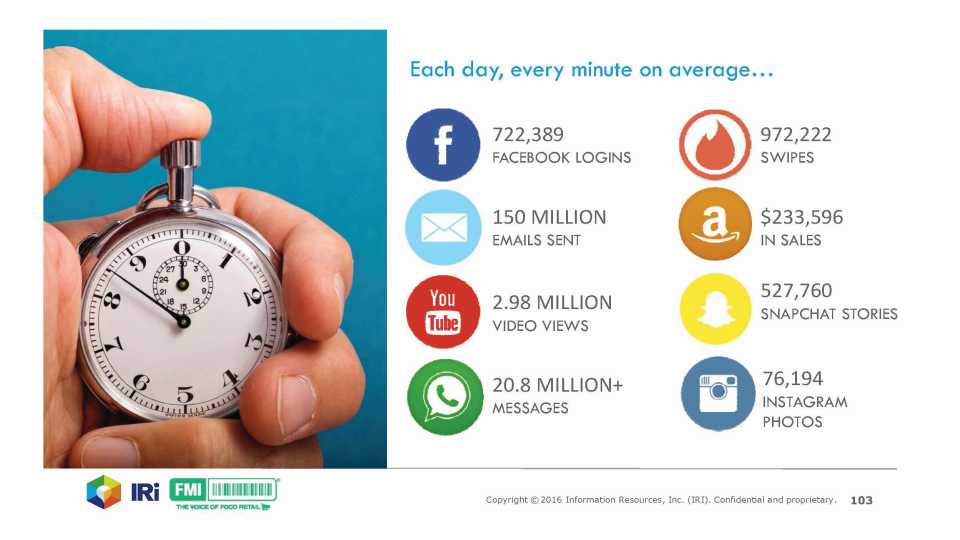

Here again education plays a role. If growers and agriculture in general choose not to be a part of these conversations, definitions will still be applied, good or bad. There are millions of conversations occurring daily related to food. Scanning popular social media platforms bear that out.

The baseline of consumer expectations for transparency is being established. They include the product origin/farm, growing practices, opportunity to provide feedback, and animal welfare. With recent foodborne illness outbreaks tied to produce, the product origin is a no-brainer, but areas like growing practices and feedback are still in the more formative stages. Growers who lead in these areas will have a competitive edge.

Stein says whether you are big or small, tell a story about your farm and be authentic. The GMO debate is a good example of how consumer perception can drive the discussion. The agriculture industry has fought the negative perception of GMOs with scientific facts for years, but the proliferation of non-GMO labels on food items in stores illustrates those arguments have lost out at least from a marketing perspective.

“Another thing about this younger generation of consumers is they know when they are being played and they understand the value they have as a consumer,” Stein says. “That means authenticity is important in how you position and market what you grow.”

Getting Ahead of Food Fads

The rise of kale and Brussels sprouts are more recent examples of produce items that took off in popularity because of the health benefits they offer and creative recipes that made them more appealing to eat.

Stein suggests growers’ most basic approach to get ahead of new trends could be talking to consumers about what fruits and vegetables they are buying and what items they are interested in, but perhaps are not a consumer of yet. Observe social media and culture to search for the beginnings of trends that might offer opportunities in marketing a different way or for growing an alternative crop.

“It is funny how a trend can get established,” Stein says. “Dragon fruit has been around forever, but it was not until Starbucks created an iced tea with it that the fruit suddenly become popular.”

In addition, there is a lot research that growers can tap into to get a feel for where consumer trends are heading. This would include FMI’s annual Power of Produce Survey, which gives an in-depth look at what consumers are looking for in their produce purchases. The latest survey will be released next month.

Looking Ahead

Stein says the successful grower will need to be ready for change and be able to adapt. The connected consumer’s access to information will only grow and will become even faster, which means change will come faster.

“One trend we see developing is the idea of how fresh is fresh,” he says. “Consumers are seeing broccoli on the store shelf and they now want to know when it was picked. That can cause a little conundrum for growers, because consumers don’t understand the relationship between harvest, the cold chain, and freshness. Here again is an education opportunity.”

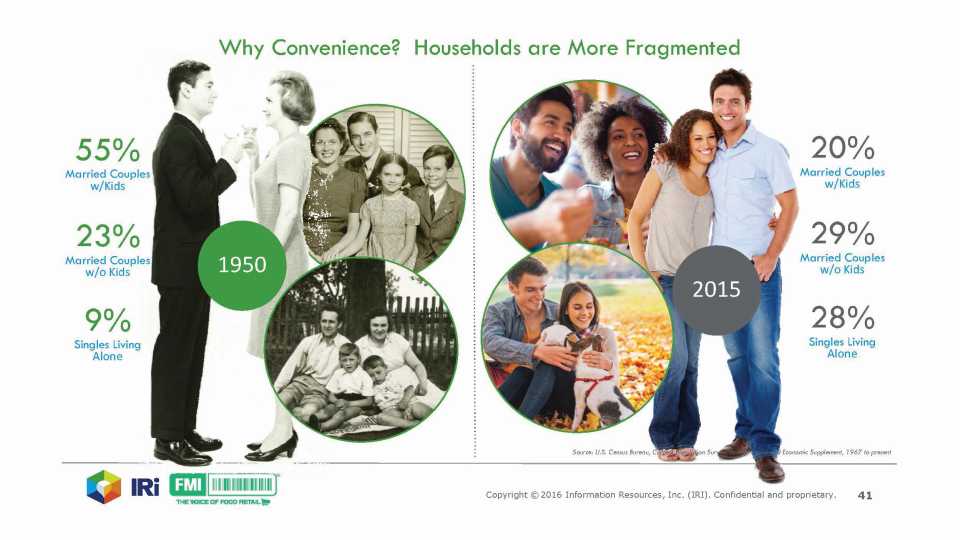

Retailers are adapting to these new consumers and changing how grocery stores and other outlets look. Stein says there are fewer and fewer people who are “pantry loaders” and many of the younger generation shop for what they need in the moment. That means stores are making larger delis with more fresh prepared foods and larger space for fresh fruits and vegetables.

“The new, connected consumer has evolved and retailers are evolving in response,” he says. “I like to use the examples of Aldi and Lidl coming in with a smaller store footprint with a focus on a diversity of fresh food and affordability. As an industry, we have to embrace this both from the grower and retail side.”