Precision Ag Tech Ready for Takeoff in Specialty Crops

For more than two decades, the CropLife-Purdue University Precision Agriculture Dealership survey has followed the adoption of technology use within U.S. dealerships and technology offerings to customers, with most responses coming from the Midwest. In 2019, for the first time, a portion of the surveys were targeted at agricultural input dealers who serve farmers growing specialty crops such as tree fruits and nuts, vegetables, berries, grapes, nursery, and greenhouses. Nineteen surveys were completed, most from California and Oregon, but also from Arizona, Colorado, Idaho, and Michigan.

Results of the survey show modest levels of adoption of many digital technologies, and substantial differences of adoption among precision agriculture tools and for the financial returns to the dealership. But dealers identify several technologies poised for rapid growth in the next few years.

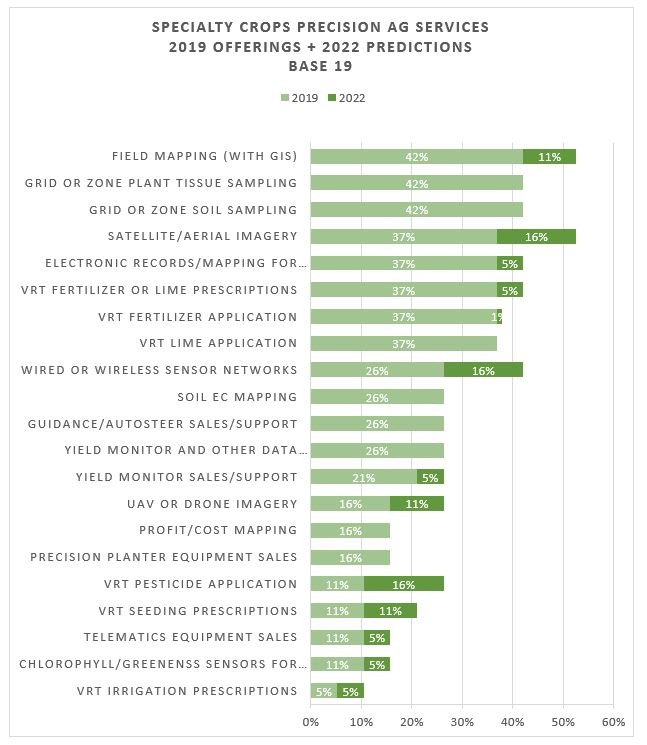

For their current offerings to growers, commonly supplied services included helping customers map their fields, conducting precision soil sampling, and precision sampling of plant tissue — all offered by 42% of retailers (Figure 1).

Following closely were satellite/aerial imagery offerings to customers, electronic records/mapping for quality traceability, variable rate technology (VRT) application of fertilizer or lime prescriptions, and VRT fertilizer or lime applications. Only a small number of dealers reported offering VRT irrigation or VRT seeding prescriptions, as well as offering VRT pesticide applications to customers.

Dealers were also asked to look beyond their current offerings and identify what they might be offering three years out, in 2022. Among dealers who are not offering them now, they indicate they will add satellite/aerial imagery, wired or wireless sensor networks, and VRT pesticide applications to their portfolios.

With each of these three precision offerings, technology advancements have increased the potential value they could offer farmers in the future. It should be noted that this data represents the percent of dealers offering these services now or what they plan for the future, not the percent of acres where these services were applied.

Looking at precision adoption overall, retailers serving specialty crop growers lag behind retailers serving field crops farmers growing corn, wheat, soybeans, etc. For example, 89% of field crops dealers in 2019 offer precision soil sampling and 88% offer VRT fertilizer applications, but just 42% of specialty dealers do precision soil sampling, and 37% offer VRT fertilizer applications (Figure 1).

Part of this difference may be that the survey showed specialty retailers custom-apply less of their pesticide and fertilizer sales compared to field crops dealers. Growers of specialty crops are probably more likely to make their own applications due to the unique management requirements of these crops compared to most field crops.

Value Creation, Profitability Challenges

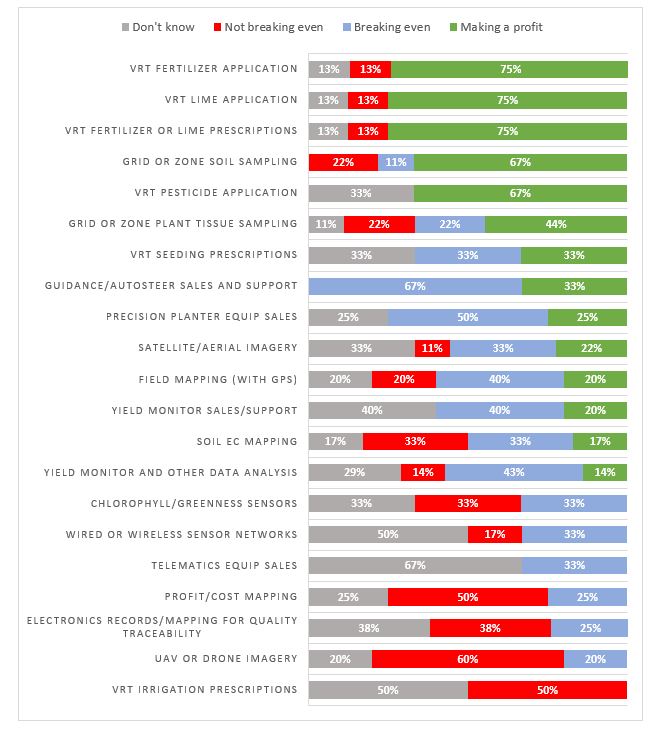

Specialty crop dealers reported an exceptionally wide range of profitability among the precision products and services they offer to customers (Figure 2). An outright positive return for a particular service offering isn’t always necessary to help a dealership stay in the black — it sure helps, but the value can often be indirect, such as enhancing customer relationships or providing a product or service not available from a competitor. Among the most profitable types of offerings are those related to precision nutrient management, where three-fourths of dealers indicated their VRT fertilizer and liming prescriptions as well as their VRT fertilizer and lime applications were making a profit, and two-thirds said their precision soil sampling was profitable.

No dealers indicated turning a profit for plant chlorophyll/greenness sensors, or for sensor networks, telematics sales, profit/cost mapping, traceability records/mapping, or UAV/drone imagery. With the exception of sensor networks, these are all services that only a small number of the dealers offer.

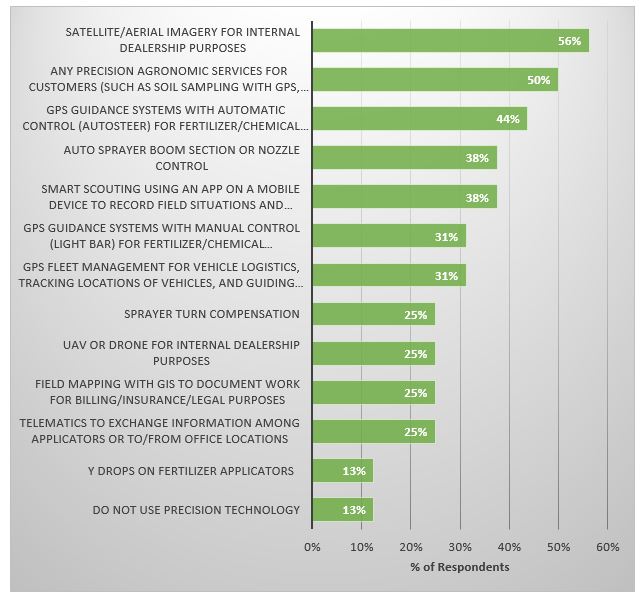

In addition to products and services offered to customers, dealers were also asked about the ways they used precision technology in their business. Satellite/aerial imagery is the most-used among the precision tools the dealers were asked about, with 56% adoption (Figure 3). This is followed by auto-guidance (44%) and sprayer boom section controllers (38%) for their custom fertilizer and pesticide applications, and smart scouting apps on mobile devices (38%). And while satellite/aerial imagery is the most adopted technology, only 25% of those who completed the survey use UAV/drones for dealership purposes.