State of the Fruit Industry: Growers to Keep on Chugging

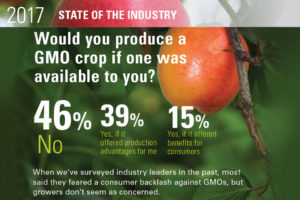

The nation’s fruit growers, in the main, like their prospects for the coming year. Consumers are looking for better flavor and nutrition. Buoyed by new varieties and technology, growers know they have good products and they’re looking forward to providing them.

Those were the chief takeaways from American Fruit Grower® and Western Fruit Grower® magazines’ second annual State of the Industry survey. Again this year our survey elicited a warm response, as a total of 632 growers, researchers and allied industry members  such as vendors, suppliers, and distributors weighed in. More than two-thirds are involved in production — 429 growers or grower/packers shared their insights. More than two-thirds of respondents are involved in production — 429 growers or grower/packers shared their insights.

such as vendors, suppliers, and distributors weighed in. More than two-thirds are involved in production — 429 growers or grower/packers shared their insights. More than two-thirds of respondents are involved in production — 429 growers or grower/packers shared their insights.

Over the next several pages, we’ll present what’s on the minds of your industry counterparts. You’ll hear from not only growers, but suppliers and researchers. You’ll read about such topics as where the next generation of growers (GenNext GrowersSM) might be coming from and trends in direct marketing.

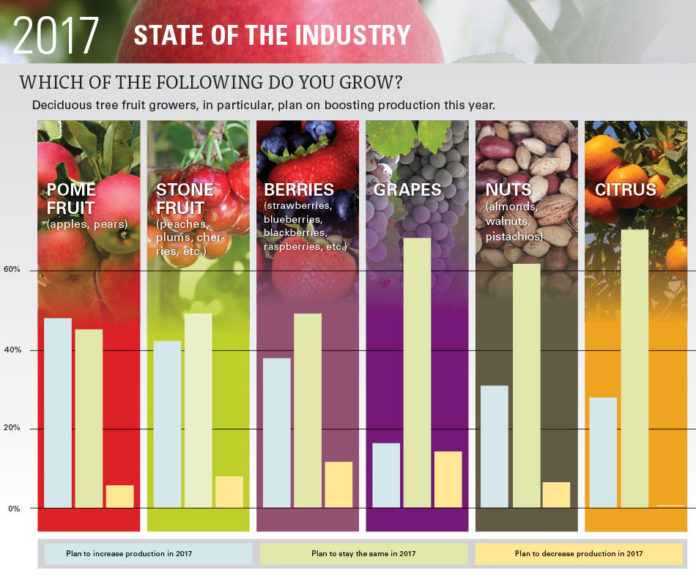

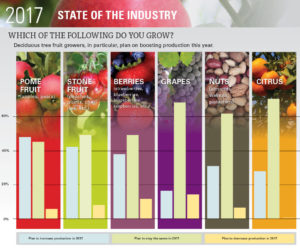

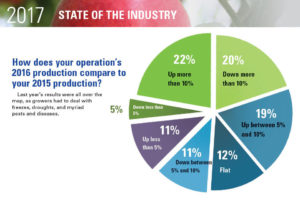

Interestingly, some of the results were remarkably similar to those from last year’s inaugural survey, at least in terms of production plans for the coming year, with growers largely echoing their 2016 plans. About half plan on similar production for the coming year, with about 40% or so looking to expand acreage, and about 10% scaling back in 2017.

There are two exceptions to the production trends. One is in citrus — these are mostly West Coast fresh-market citrus growers, not the orange juice growers of Florida, and we cover them in Western Fruit Grower — as no growers said they were going to decrease production in the coming year. That’s partly a result of the extraordinarily large number of growers — nearly one in four — who said they would reduce production in 2016. In other words, those who planned to cut back, likely because of fears of the incurable disease huanglongbing (HLB), have already done so.

The other exception is in grapes. Expansion plans have been curtailed, as only 17% of growers said they were going to increase production in 2017, less than half as many who said they had planned to in 2016. This is due at least in part to the plans of winegrape growers in California’s San Joaquin Valley, who produce the bulk of the state’s — and thus the nation’s — winegrapes.

Of course, the bulk of the two crops above is produced in Golden State, where questions about water supplies abound.

One final note: New this year, we have devoted each of our main crop categories: grapes, berries, nuts and pome and stone fruit, to further explore the results of our survey. Check out what’s on the minds of not only those who produce the same crops as you, but what others might be thinking. You might be surprised.

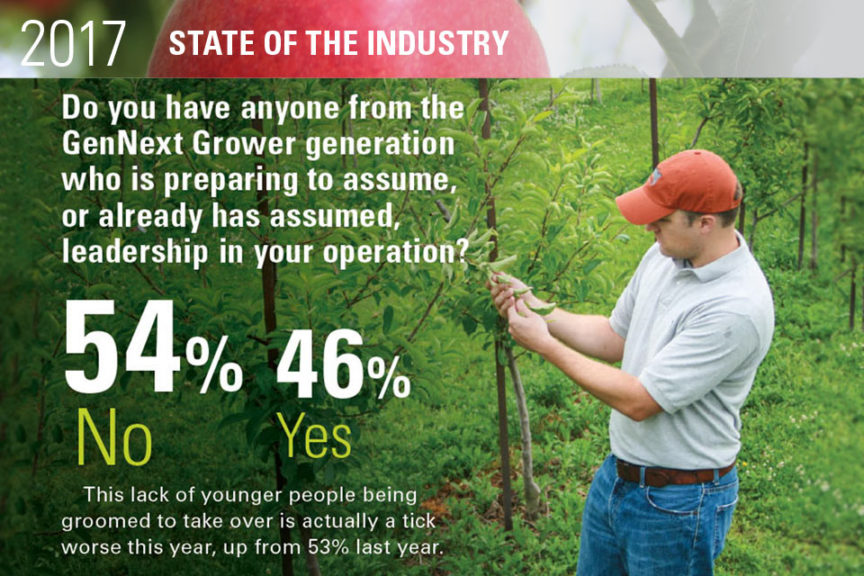

Wanted: Tomorrow’s Growers

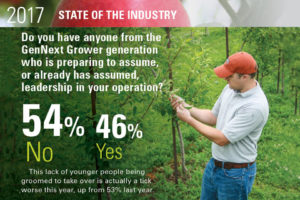

It’s no secret that growers aren’t getting any younger. In fact nearly 74% of respondents to the State of the Industry survey told us they are 55 or older. This is keeping with a 30-year trend in which the average age of a farmer has continued to grow. The average grower nationally is now 58.3 years old, according to data from the latest U.S. Census of Agriculture. With a new survey being conducted soon, that number is expected to continue to rise.

And so it’s even more stressful that growers are finding it challenging to locate someone to take over when they’re ready to retire. More than 54% of our survey respondents say there is no one to continue the business.

“This is certainly an issue,” says a Northwestern grower whose family business has been in operation for more than 10 years.

A Northeastern grower whose operation has been in business for 25-50 years says succession to the next generation is the biggest challenge to his business.

“[We’re] on a conservation easement to keep it out of houses and give young people the opportunity to experience farming without having to borrow from parents — if they have parents that can afford it,” he says.

Instead of passing his farm on to another generation, he “decided to retire and lease the land to a younger farmer in 2016.”

Instead of passing his farm on to another generation, he “decided to retire and lease the land to a younger farmer in 2016.”

Another grower in the West, whose operation has been in business for more than 50 years, says “I intern students, family members on the periphery, ranchette pressure quite high and has me land-locked.”

A Southeastern grower whose business has been in operation for more than 25 years says “competition with off-farm work,” is the biggest challenge for finding someone to assume operation of the business.

A Southwestern grower whose family business has been in operation for more than 10 years is concerned about the future, saying he “will probably have to sell upon retirement.”

A Northeastern grower whose family has been in operation for more than 10 years says “We are quietly looking for a buyer now.”

“As I get older I can’t keep up with the work,” says a grower in the West whose family business has been in operation for more than 25 years. “I hope there are some who would rather work with dirt than punch a computer.”

Growers also think the next generation sees farming as grueling work — assumed to be too hard for those who might be potentially interested.

“There is no one in our family who wants to do this hard work,” says a Southeastern grower whose family business has been in operation for less than 10 years.

This is echoed by a grower in the West, with a business in operation for more than 25 years.

“Growing fruit is HARD WORK and the GenNext generation wants to sit behind a computer,” he says.

Not only hard work, but the increase in paperwork and government regulations makes joining a family business a difficult sell, says a Western grower whose family has been farming for more than 10 years.

“Our three sons don’t want to deal with all of the regulations; the farming part they don’t mind,” she says.

However, there are bright spots for growers, including one Southwestern grower whose family business has been in operation for 25-50 years. She says “my son is working on helping us get help.”

And a Northwestern grower whose family has been farming for more than 25 years happily says, “My daughter bought our operation.”

Vendors Say Sales Growing Strong

A quarter of the industry vendors responding to the State of the Industry survey said their 2016 sales were up more than 10% over the previous year, and half reported sales were up at least somewhat. Just 21% reported sales were down.

Just 15% expect sales to be down in 2017, and a solid 74% expect sales to be up, with nearly 20% expecting sales to be up by more than 10%.

As for what issues their companies were facing, three of the nine possible answers stood out, being listed by at least half of the suppliers: competition, economy, and regulatory issues. Other issues identified by at least 20% of the suppliers were, in descending order: consolidation of growers, water and/or drought, and mergers and/or consolidation of fellow suppliers.

As part of the survey, suppliers were asked for their expectations for the coming year. Here are their answers to a few questions, prefaced by their region of the country and product category.

What are the trends you’re seeing for 2017?

Northwest, Crop Protection: “More growers are tightening the belt.”

Midwest, Crop Protection: “Grower concern about crop pricing & farm credit access.”

West, Crop Consultant: “More growers going organic.”

Northeast, Nursery: “Increased demand for fresh berries. Demand is 10-20% higher than supply. Lack of labor to grow sales.”

Northeast, Postharvest and Packing: “Too many managed varieties.”

What would you like growers to do that would improve profitability for both them and your company?

Midwest, Fertilizers: “Take a more active interest in understanding how a comprehensive, plant physiology-based nutrition plan can improve their crop protection plan and improve fruit quality, yield, and ROI.”

Midwest, Crop Protectants: “Raise the Brix of the produce.”

West, Crop Consultant: “Be honest when considering ROI not only to them but to the soil and community around them?”

Northeast, Nursery: “Be politically involved. Push back on regulation.”

Northwest, Crop Protection: “More Growers need to look forward more than one year and realize that frost control means a lot to their bottom line.”

What excites you most in the fruit industry?

Midwest Irrigation: “Expansion of high-density orchards. The automation of harvest equipment.”

Northwest, Crop Protection: “The fruit industry is enjoying decent prices because of new varieties. The nut industry — not so much.”

Midwest, Fertilizers: “The top growers continue to get more technical and continue to improve efficiencies. This leads to opportunities for suppliers.”

Southwest, Soil Amendments: “With a growing world population, the fruit and nut industry will grow at an increased rate.”

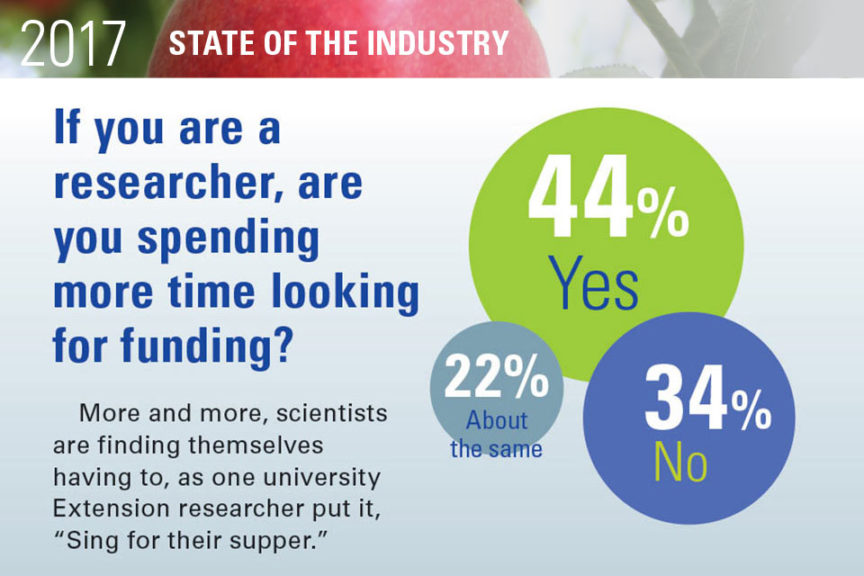

Researchers Say: Better be on your Toes

If there was a theme to researchers’ responses to our State of the Industry survey, it was that as the Information Age continues to ramp up speed, everyone in the fruit industry had better keep their foot on the gas — or get ready to get run over.

Researchers from all over the country contributed. The geographic representation was excellent, with 30% from the West, 26% from the Southeast, 15% from the Northeast, and 13% from both the Northwest and Midwest.

There was also a nice sampling in terms of crop categories, with researchers working in the following areas, indicating all that would apply: stone fruit, 56%; pome fruit, 54%; berries, 43%; grapes, 42%; nuts, 29%; and citrus, 28%.

Researchers offered responses on a number of topics, and their answers will be explored in the pages of American Fruit Grower® and Western Fruit Grower® magazines throughout 2017, but here’s a sampling of answers to one question:

I f you could offer the average grower one piece of advice, what would it be?

f you could offer the average grower one piece of advice, what would it be?

• “Old, but needed advice: Don’t plant until you know there’s a market or buyer for the fruit.”

• “Attend educational meetings and mingle with other growers and Extension specialists.”

• “If you possibly can, be a social media voice explaining why you do what you do to feed the rest of us.”

• “Do a strategic business plan considering genetic and engineering technologies to optimize your ROI and deliver your customer the highest quality consistently.”

• “Be creative. Often the best innovations start with an idea or a question that comes from you.”

• “Put money aside for a rainy day; by the same token, invest in new technology.”

• “Plan now for future change. Forget what you want to grow, grow what the customer is buying and what they think that they want.”

• “Diversify! Second would be to manage your operation by taking care of the things over which you have control and don’t spend time worrying about the things beyond your control.”

• “Have a detailed plan to promote and market your product before you plant it. Too much volume gets dumped on the market with no marketing plan.”

• “Either get more involved with proposed government regulations or hire someone to stay up to date with regulations in your organization.”

• “Be actively engaged in your local organizations and commodity organizations to protect your future.”

• “In order for U.S. growers to remain competitive, we will need strategic investments in research at the U.S. Land Grant institutions to develop new varieties/cultivars and to spur innovation across all fruit sectors.”

Farm Marketers Say: Mother Nature is Boss

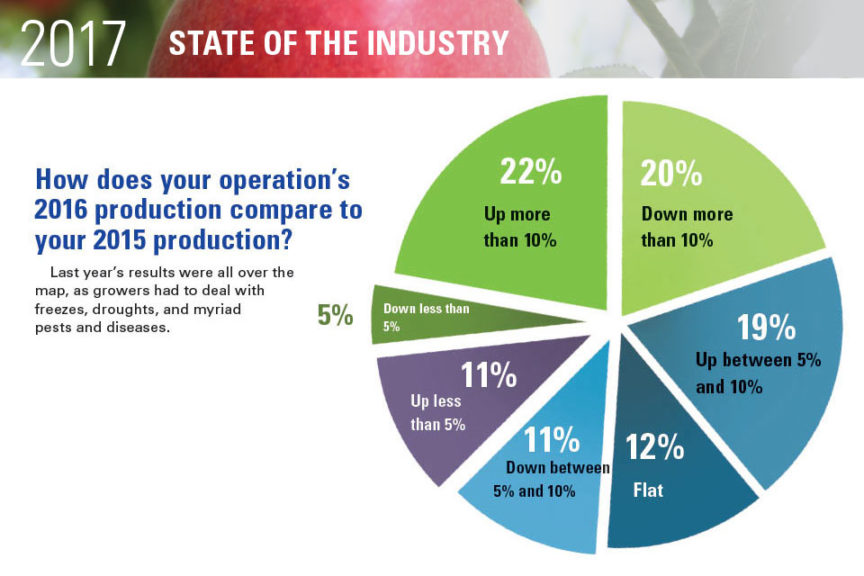

The volatility of weather in the Midwest and Northeast last season made a big impact on production for direct marketers. While 21% of respondents to our State of the Industry survey say production was up more than 10% for their business, that is only slightly higher than the 19% who say it was down by more than 10% in the 2016 growing season.

This feast or famine theme was carried over when the majority of direct marketers responding to our State of the Industry survey — 63% to be exact — say the weather negatively impacted the direct-market business. Other issues, such as labor, the economy, competition, and food safety rules also vexed direct marketers.

Customers’ mindsets also upset the stability of the direct marketing business, says some respondents to our survey.

“There don’t seem to be as many customers as there used to be, possibly too many markets, maybe changes in lifestyle,” says a grower from the Midwest in operation for more than 10 years.

Another grower from the West, whose operation has been in business for more than 25 years, says she has noticed a change in the land surrounding her family’s farm.

“[The] area has changed from agriculture to residential and the support businesses have diminished or are gone completely locally,” she says.

A direct marketer who operates a pick-your-own farm in the Northeast said the biggest obstacle for 2016 was something out of her control — construction. This can be very frustrating when access to your farm is interrupted and your crops are prime for picking.

“The biggest issue for us this year was major road work being done on either side of us and right at our driveway through much of the picking season,” she says.

A direct marketer from the Northwest in business for more than 50 years says he’s worried about the health of his business, because it “is not sustainable long term, people are too used to cheap fruit.”

On a positive note, though, many direct marketers say the strong connection to the community in which they farm is a strength of the industry they’re in.

“Some folks travel 60 to 100 miles to pick their own grapes on the farm. We hear their stories and tell them about the farm/vineyard,” says a Midwest grower in operation for more than 10 years. “Helping people learn the benefits of juice, jelly, and wine from grapes they pick is fun for us and a benefit to our community.”

This is echoed by a grower in the Northwest in operation for more than 25 years who says his family’s roots are a selling point. ‘[We have a] strong connection to the community.”