Why the Future Is Still Looking Bright for Pistachio Growers

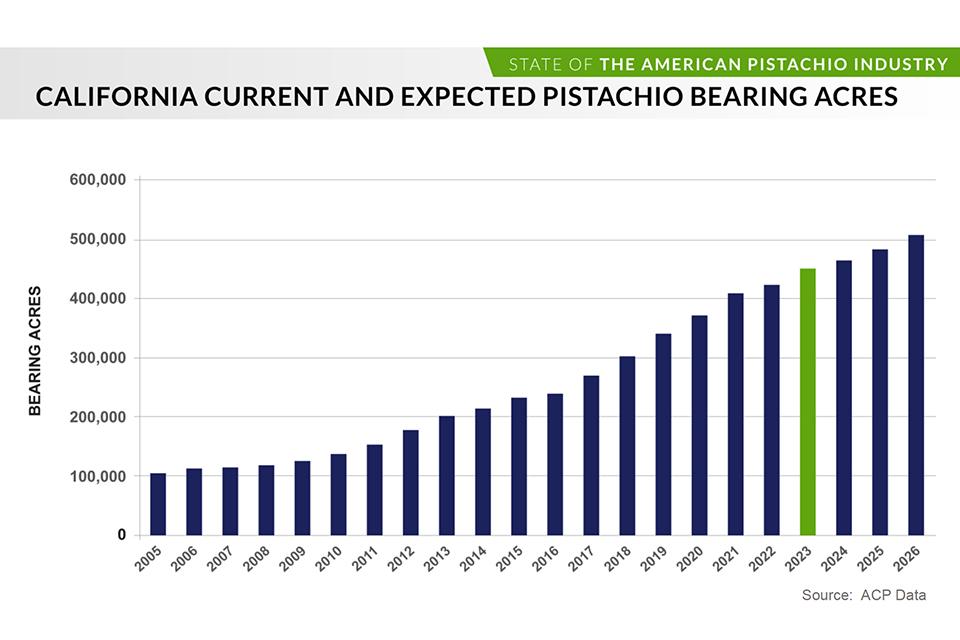

California pistachio growers have enjoyed a terrific millennium so far, continuing to plant while prices have largely held strong. By 2020, the number of bearing acres exceeded that of apples, 322,000, in the entire U.S. By 2026, growers expect to have more than half a million acres of bearing pistachios in California.

Pistachio growers are the envy of most other specialty crop growers in the U.S., but try telling that to Richard Matoian. The President of American Pistachio Growers is paid to help steer the industry clear of the many obstacles facing growers today, so it makes sense he focuses on industry challenges.

However, the numbers tell the story. How many other crops in America boast a track record this millennium like pistachios? Bearing acreage has gone up each and every year. Since 2005, when growers hit the 100,000-acre mark, the crop has zoomed to more than 400,000 and is projected to hit the 600,000-acre mark in 2026.

The 2021 farmgate value, the most recent data available from the California Department of Food and Agriculture, pegs pistachios at $2.91 billion, nearly as much in the state as lettuce and tomatoes combined. Not bad for a relatively infantile crop.

Pistachios are the nation’s “newest” commercial crop, as it was first planted in California in any numbers in the 1970s, and that’s one factor driving the steady growth, simple availability. The more people who taste pistachios, Matoian says, the more people like them.

This year’s shipping numbers provide some insight. For the first half of APG’s 2022-2023 marketing year, which began Sept. 1, total shipments are tracking above last year, and last year was a record-breaker. Matoian notes this news even though domestic exports are slightly down, meaning exports are way up.

Shipments to such important markets as the Middle East and India have been especially high recently. For example, Matoian points out shipments to India — one of the world’s fastest-growing markets — totaled 4 million for the first half of the 2021-2022 marketing year, compared to a whopping 22 million this year during that same timeframe.

EXPORT HEADACHES

Farming pistachios is still farming, however, and that means challenges, lots of them. Matoian says the biggest today, as growers everywhere can attest, is inflation. Inputs of all types are rising, and that’s when they are available, which brings up a related problem, supply chain interruptions. Growers report it’s simply difficult to get all the products they need for their farms.

Interrelated with the supply chain problems are issues facing any export product. Because pistachio growers are so heavily dependent on exports — fully 65% of the crop, much like almonds and walnuts, is sent overseas — these issues are of particular importance. For example, a worldwide recession and a strong dollar combine to make relatively pricey pistachios even more expensive, particularly against the Euro.

But other export challenges are unique to nuts and dried fruits. For the first time, the European Union has instituted a standard for ochratoxin, a member of the mycotoxin family, which also contains the more infamous — at least to nut growers — aflatoxin. In response, Matoian says the industry is doing additional pretesting, with processors pulling samples at random, to make sure the loads they send to the EU are free from ochratoxin.

“The industry imposed this on itself,” Matoian says. “It’s a big deal in that it’s yet another regulation for processors, it’s another hoop they have to jump through.”

QUALITY TRUMPS ALL

Among all the export issues, however, there is one issue that weighs inordinately heavily on Matoian’s mind.

“It’s tariffs, or should I say, the potential for tariffs,” he says. “Tariffs have a huge impact on the ability of any commodity to ship into a given country.”

Richard Matoian

Specifically, the tariffs that keep Matoian up at night are those that were imposed by China in 2018 in retaliation for then-President Trump’s steel and aluminum levies. Growers have weathered the tariffs — 50% for raw pistachios, 30% for roasted — extremely well in part because Americans continue to produce bountiful harvests. Their biggest rivals, the Iranians and Turks, have not fared as well in recent times.

The California pistachio industry has grown up, and it’s doing well because growers have always emphasized quality above all, a strategy that works well in most situations, but today has put it on the top shelf of global gourmets.

“The U.S. is now the world leader as a consistent source of quality product,” he says. “People used to source from Iran as well, but if you really want quality product going forward, the U.S. is going to be the supplier of that product.”