How Harvey May Impact Specialty Crop Growers

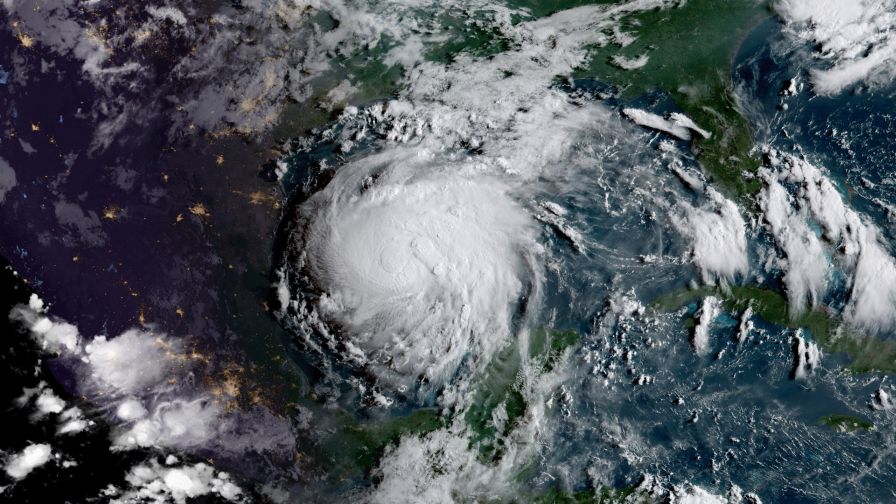

The devastating human toll from Hurricane/Tropical Storm Harvey has rightly dominated news coverage. Growers and those who work with them, however, should also think about how this historic storm will also affect specialty crop growers in the region and across the U.S.

Farms Within the Flood and Storm Zone

If your operation was in the direct path of Harvey, USDA has a few sites up and running for you so you can start the disaster relief aid process — Disaster Resource Center and Hurricane Harvey Resources.

It also has a site on how to handle food safety at your operation following a flood.

Shipping Will be Disrupted and Freight Costs Will Rise

Within the next few days, arteries into Houston will begin to open, but are currently still closed. Houston is the fourth most important water-related shipping hub for agriculture, a 2015 USDA report states, so it’s closure will create reverberations through the industry.

Railroads and interstate freeways are also closed, and all of these will require inspection to ensure they’re safe to travel through and on. Within Texas, trucking rates rose 37 cents per mile over the previous week, Fleet Owner magazine says. It also reported that Harvey may ultimately sideline a full 7% of the U.S. trucking industry.

These freight increases are likely to continue for several weeks, Journal of Commerce says. Freight will likely rise across the country, and will rise sharply in Texas and nearby states.

One big unknown cost is how much gasoline prices will rise. Houston is home to almost a quarter of U.S. oil refineries. If the receding waters reveal little damage to refineries, then you can expect a 10 to 15 cent increase per gallon, according to a report from CBS News. But if they require significant repairs and will be offline indefinitely, it’s hard to estimate how much gas prices will rise.

Imports and Exports May be Slow to Rebound

Houston is a major export hub for fruit and vegetables in the South Central U.S., Fleet Owner magazine reports. Any exports waiting to be loaded on ships remain in warehouses and will need to wait for the shipping channels to be inspected and opened before shipping resumes. And it will not be a normal shipping pattern for some time, since there will be a high priority on relief efforts over commercial ones.

As for imports, incoming ocean cargo has been re-routed to the East and West Coasts, causing significant delays. That rerouting will likely continue until all shipping routes are fully functional again, and emergency relief efforts begin to scale down.

The USDA report, “Fresh Fruit and Vegetable Shipping Point Trends,” reviews pricing for fruit and vegetable imports. The most recent report, which was issued Tuesday, August 29, makes almost no mention of Harvey, so it’s difficult to tell if the report takes the storm into account in its pricing predictions for the next week. All vegetables crossing into Texas from Mexico are predicted to have unchanged prices or be lower, with only two exceptions: small cucumbers, which will have slightly higher prices, and grape-type tomatoes, which will be much higher in price. Other cucumber sizes and tomato types will not see any increases, according to the report.